That means if you made any qualifying home improvements in 2017.

Government efficient roof tac credit 2017.

Here are some key facts to know about home energy tax credits.

Irs tax tip 2017 21 february 28 2017.

Federal income tax credits and other incentives for energy efficiency.

Here s what you need to know when filing for tax years 2019 2020 and 2021.

There is no upper limit on the amount of the credit for solar wind and geothermal equipment.

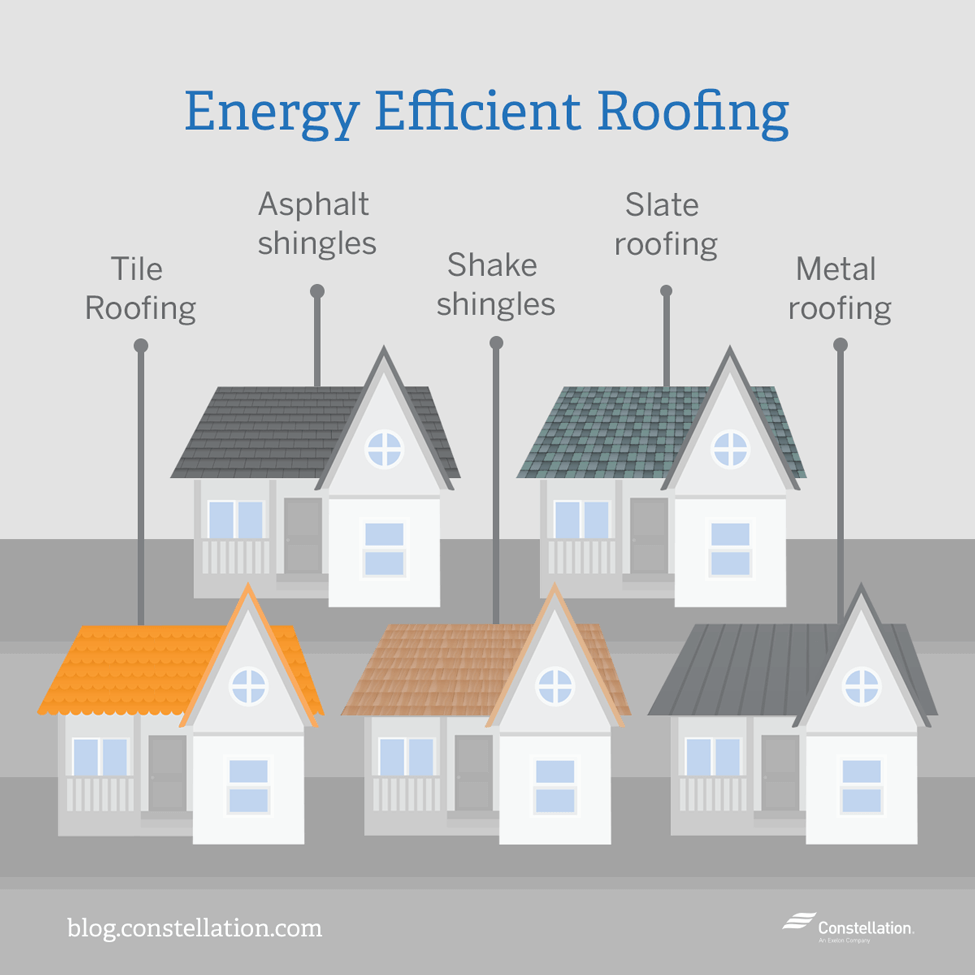

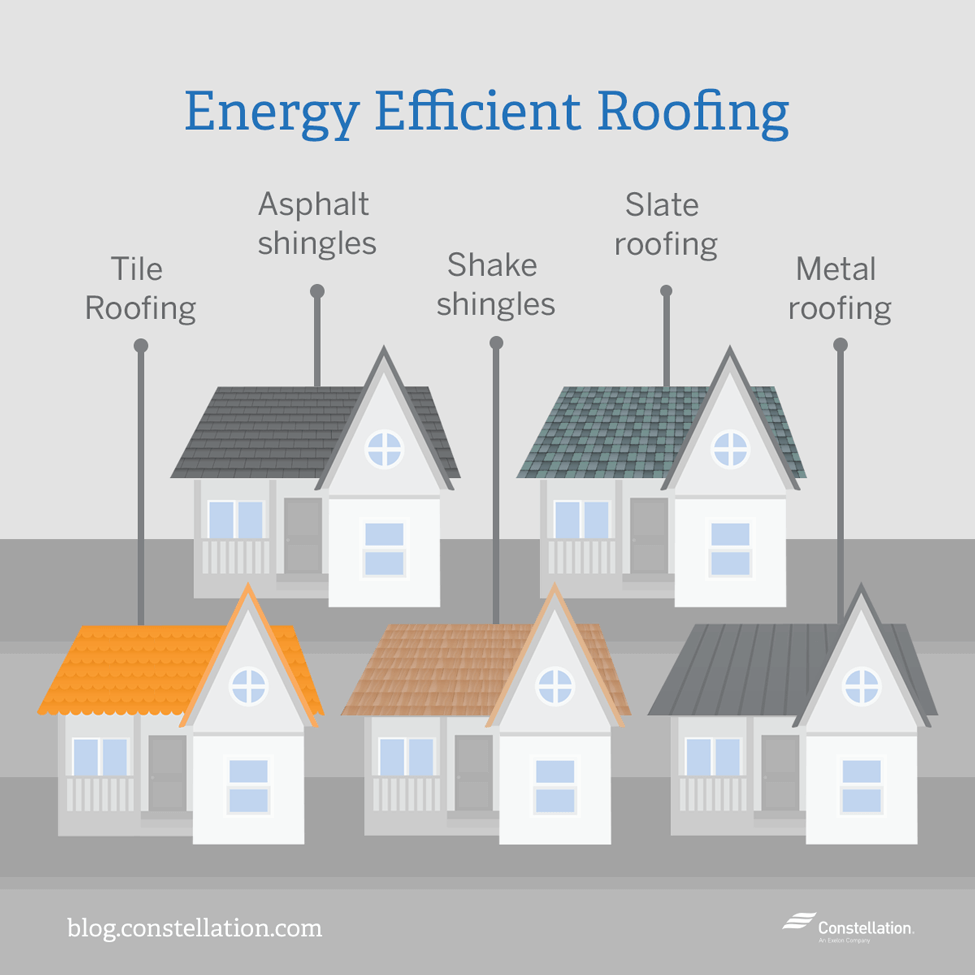

Homeowners may qualify for a federal tax credit for installing certainteed energy star qualified roofing products.

The credit had previously been extended by legislation.

The type of credit you may qualify for is listed in part ii for nonbusiness energy property which allows you to claim up to a 10 percent credit for certain energy saving property that you added to.

If you are replacing or adding a new roof to your home you could qualify for an energy efficient home improvement tax credit for as much as 10 percent of the cost not counting installation costs.

Here s how to add your roof tax deduction to your tax return and the requirements to receive a roof tax credit.

The consolidated appropriations act 2018 extended the credit through december 2017.

Part of the huge bipartisan budget act passed last month was an extension of tax credits for energy efficient upgrades to your home.

The credit is equal to 30 of the cost including installation.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

The homeowner s primary residence may be eligible for the tax credit.

Homeowners who have not submitted for the tax credit for any energy efficient home improvement new windows doors insulation or energy star qualified roof may qualify.

Non business energy property credit.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Homeowners who made energy efficient improvements to their home can qualify for a federal tax credit but you must meet certain rules.

Summary of tax credit under the bipartisan budget act of 2018 which was signed in february 2018 a number of tax credits for residential energy efficiency that had expired at the end of 2016 were renewed.

The energy efficient tax credit has a limit of 500 for all tax years after 2005.